Whilst the market for new buses and coaches remains relatively buoyant and manufacturing lead times are reducing, an industry-wide return to pre-2020 levels of vehicle supply stability remains some way off, according to a senior industry executive.

The number of registrations of coaches, buses and minibuses in the UK rose in 2023 compared to the previous year, led by a sharp increase in sales of double-deckers, according to figures from the Society of Motor Manufacturers and Traders (SMMT). Across all three types of vehicles, the number of registrations was 4,932, which is up 45% versus 2022.

Double-decker sales tallied 944, which was an increase of 174% on the previous year. The single-decker total was 1610, which was 53% up, while minibus saw an 18% rise to 2,378. Despite the encouraging numbers, the overall total was 16% down on the registrations for 2019.

Commenting in the trade press, Scania UK’s Sales Director Mark Bridgland, acknowledged that the past few years have seen difficulties as a result of external factors impacting on the supply chain, but confirms that lead times have reduced across the Scania range as control of the supply chain is regained.

Mr Bridgland believes that cross-sector difficulties since 2020 have served to make all manufacturers “far more agile” in responding to geo-political challenges and taking steps to mitigate future risks to the supply chain.

“If we look at the last 30 to 40 years, we have been in a global economy with things relatively stable,” Mr Bridgland said. He added that the current landscape, exemplified by matters such as the war in Ukraine, conflict in the Middle East and UK governmental upheaval, may become “the new norm,” at least in the medium-term.

Mr Bridgland’s comments echo those of another manufacturer in the coach field. It recently noted that delays to vehicle completion due to component availability have fallen greatly since 2022, but that more improvement is needed before more favourable lead times return.

Suggestions from the operating side are that certain late used stock is selling for no less than what it was first purchased for because of that pressure.

Mr Bridgland adds that the influence of Chinese OEMs on the coach and bus market is keeping other builders “on their toes,” although he notes that Scania sees “some huge opportunities” in the segment going forward, particularly around decarbonisation.

John Dwight, Sales Director of Imperial Engineering, which supplies Scania bus and coach parts to operators across the UK, commented:

“Further year on year improvement in the level of new vehicle registrations for buses and coaches is to be welcomed and demonstrates the resilience of the sector in tackling the challenges of transitioning to zero emission transport.

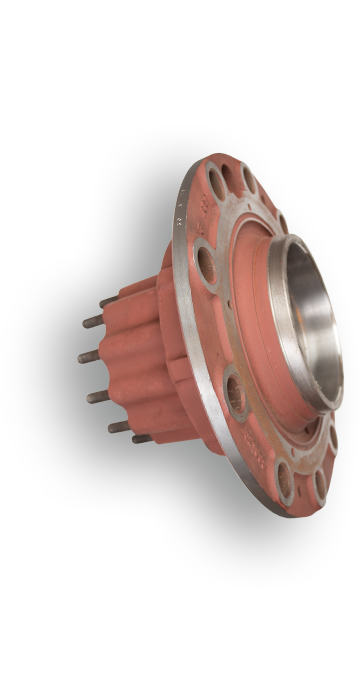

Whilst it’s very encouraging to see operators making investments in new vehicles, which is great for passengers too, there is still significant investment in preserving the existing service fleet, which Imperial Engineering is at the forefront of supporting. As a major distributor of OE and remanufactured parts covering all major manufacturers, for bus and coach operators of all sizes, Imperial Engineering continues to respond to customer needs in a tough economic climate.”